As a real estate agent, it's crucial to communicate the financial advantages of home ownership, particularly how it serves as the ultimate hedge against inflation. By focusing on home appreciation, you can effectively guide your clients through their decision-making process and help them understand the long-term benefits.

Key Talking Points on Inflation and Home Ownership

Stable Payments:

Explain to your clients that a fixed-rate mortgage ensures stable monthly payments, offering financial stability as cost of living increases. This predictability is a significant advantage over renting, where payments can rise with inflation. Even with changes in taxes and insurance, the principal and interest payments remain the same.

Tax Benefits:

Highlight the potential tax benefits of home ownership. Mortgage interest, insurance premiums, and property taxes may be tax-deductible, reducing your clients' overall tax burden. Encourage clients to consult with a tax advisor to understand the specific benefits they can enjoy.

Freedom to Renovate:

Emphasize the freedom that homeowners have to make changes or renovations without needing landlord approval. Whether they want to remodel the kitchen, add a new bathroom, or create a garden oasis, owning a home allows them to customize their living space to fit their personal tastes and needs.

Access to Funds:

Discuss the benefits of a Home Equity Line of Credit (HELOC). This financial tool allows homeowners to leverage the growing equity in their home to finance improvements, renovations, or other needs. This can further increase the home’s value and provide additional financial resources.

Home Appreciation:

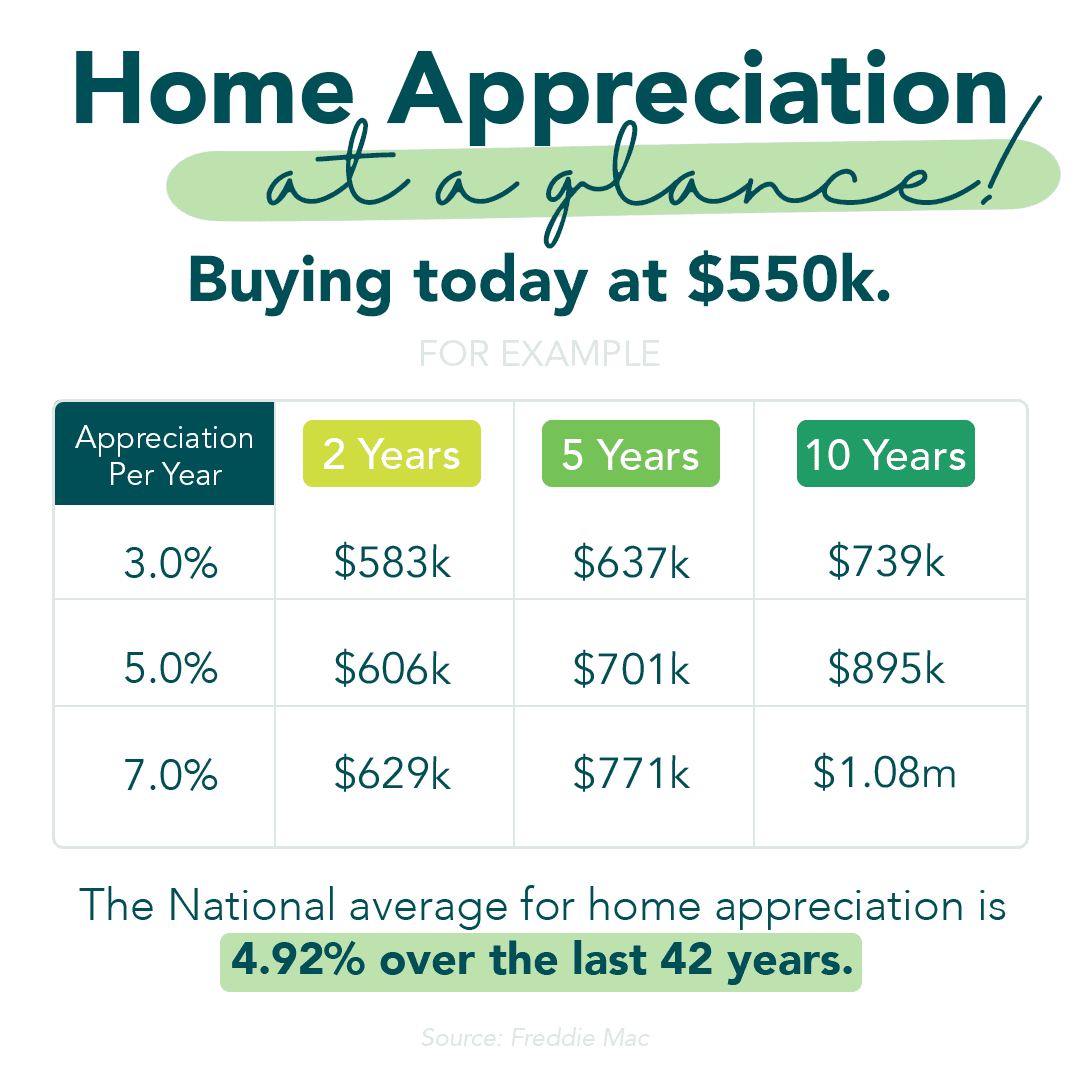

Show your clients why owning a home is a powerful defense against inflation. In the scenario below, a home is purchased at the price of $550,000. As illustrated in the graphic below, even a modest annual appreciation rate of 3% would increase the home’s value to $739,000 over ten years (+$189,000). With higher appreciation rates, the benefits can be even greater. At a 7% appreciation rate, the home’s value could reach $1.08 million in 10 years (+$530,000), nearly double the original purchase price of the home.

Conclusion: Simplify the Value of Home Appreciation.

As a real estate agent, being able to discuss how homeownership offers stable payments, tax benefits, renovation freedom, and access to funds via a HELOC will make you more valuable to your clients. In addition, the example graphic above is a simple yet powerful visualization to help your clients understand the value of owning a home. By demonstrating how home appreciation works over time, you can simplify the financial benefits of buying over a set period.

Pro tip: Conduct a little market research and add your market’s appreciation rate to the graphic before sharing.

Expert tip: Find out when or if your clients might want to relocate again. One example could be a couple looking to sell and relocate after their kids finish school. Set the time horizon to match their youngest’s graduation, and show them how much appreciation they’ll gain in the interim!

As a real estate agent, your role is to educate and guide your clients through the home buying process. Emphasizing the financial advantages of home ownership, especially as the ultimate hedge against inflation, can help them make informed and confident decisions.